What type of Health Insurance Plan is right for you?

Health Maintenance Organization (HMO)

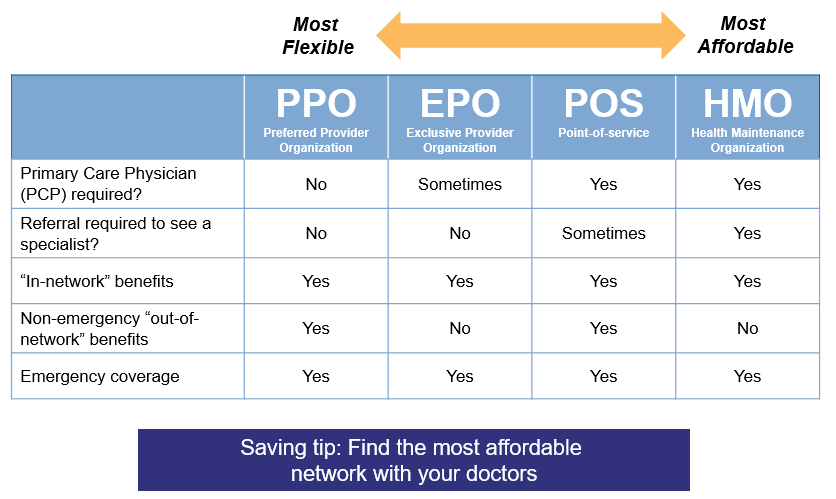

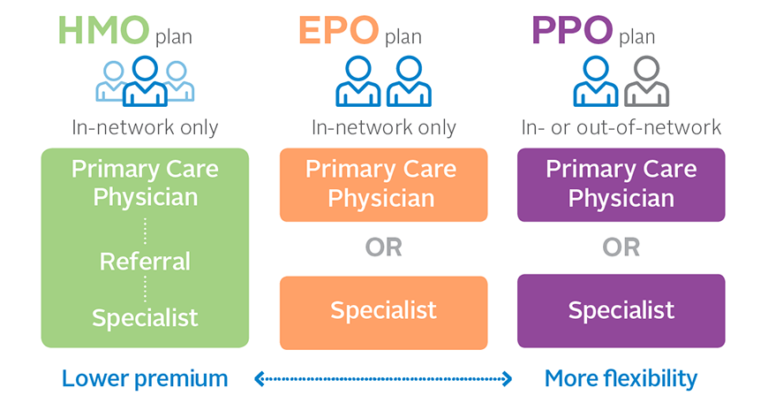

HMO’s require primary care provider (PCP) referrals and won’t pay for care received out-of-network except in emergencies. However, they tend to have lower monthly premiums than plans that offer similar benefits but come with fewer network restrictions. HMO’s offered by employers often have lower cost-sharing requirements (i.e., lower deductibles, copays, and out-of-pocket maximums) than PPO options offered by the same employer. However, HMO’s sold in the individual insurance market often have out-of-pocket costs that are just as high as the available PPO’s.

Preferred Provider Organization (PPO)

PPO’s got this name because they have lists of healthcare providers that they prefer you to use. If you get your health care from these preferred providers, you pay less. PPO’s are a type of managed care health insurance plan. A PPO limits from whom or from where you receive healthcare services by the use of a network of healthcare providers with whom it has negotiated discounts. A PPO’s network includes not just physicians and other healthcare providers, but every imaginable type of healthcare service like labs, X-ray facilities, physical therapists, medical equipment providers, hospitals, and outpatient surgery centers. It’s important to understand that a PPO can have a broad network or a narrow network. If you pick a broad-network PPO, it should be fairly easy to stay in-network and get the lowest possible out-of-pocket costs. But if your PPO has a narrow network, you might find yourself going outside the network more often than you had planned. The out-of-pocket maximum can be as much as twice as high if you’re receiving care outside the network.

Exclusive Provider Organization (EPO)

EPO’s got that name because they have a network of providers they use exclusively. You must stick to providers on that list or the EPO won’t pay. However, an EPO generally won’t make you get a referral from a primary care healthcare provider in order to visit a specialist. Think of an EPO as similar to a PPO but without coverage for out-of-network care.

CONTACT us

Have any questions? We are always open to talk about your healthcare and how we can assist you in any way.